The Secret to Saving $500 a Month Without Cutting Out the Fun

February 12, 2025 | by Edward Jones

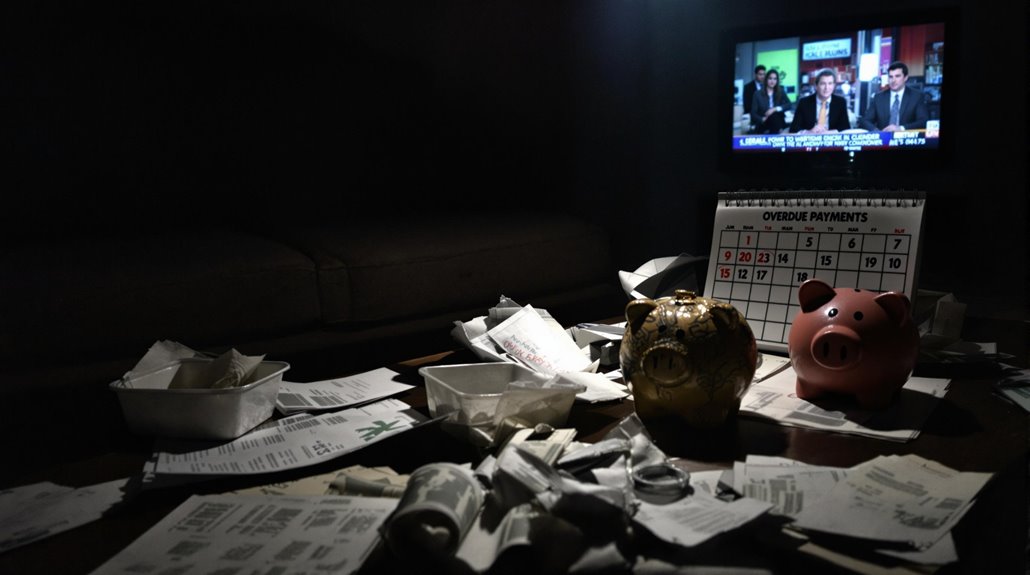

To save $500 a month without cutting out the fun, start by rethinking your daily spending habits. Brew your coffee at home, pack lunches instead of dining out, and review subscriptions to cut unnecessary costs. Embrace budget-friendly alternatives like cooking with seasonal ingredients or shopping second-hand. Smart planning is key; create a budget, categorize your expenses, and automate your savings. These simple adjustments can help you enjoy life while putting money aside for your future. Explore more strategies to enhance your savings journey!

Key Takeaways

- Brew coffee at home and pack lunches to save significant amounts without sacrificing enjoyment.

- Scrutinize and eliminate rarely used subscription services to redirect funds towards fun activities.

- Opt for budget-friendly entertainment options like community events or potlucks to maintain social enjoyment without overspending.

- Cook at home with seasonal ingredients, allowing for creativity while reducing dining-out costs.

- Set realistic savings goals and celebrate small victories to stay motivated without feeling deprived.

Rethink Your Daily Spending Habits

What it Looks like: Rethinking your daily spending habits might mean re-evaluating your morning routine, meal choices, and entertainment options. For instance, instead of grabbing a $5 coffee every day, consider brewing your own at home for mere cents per cup. If you typically eat out for lunch, packing a homemade meal can save you upwards of $10 per day. Additionally, scrutinizing your subscription services and eliminating those you rarely use can effectively redirect funds toward savings. By making small adjustments to your daily expenditures, you can accumulate significant savings without drastically altering your lifestyle.

Why It's Smart: Adopting a more mindful approach to spending can lead to a substantial increase in your monthly savings. When you start tracking your expenses, you may discover surprising patterns and areas where you can cut back. For example, limiting impulse purchases and opting for budget-friendly alternatives not only reinforces financial discipline but also helps build a savings cushion. By training yourself to prioritize needs over wants, you create a more sustainable financial future. The discipline cultivated through these changes can also lead to healthier financial habits that benefit other areas of your life, such as investing for retirement or paying off debt.

Things to Be Aware of: While it's important to limit unnecessary spending, be mindful of not depriving yourself excessively, as this can lead to burnout and eventual overspending. Striking a balance between frugality and enjoyment is key; allow yourself occasional treats to maintain motivation. Additionally, be cautious of falling into the trap of "cheap" purchases that may accumulate over time, ultimately negating the savings you intended to achieve. Finally, verify that you are setting realistic savings goals; it's crucial to celebrate small victories along the way to stay motivated in your journey toward saving $500 a month.

Embrace Budget-Friendly Alternatives

What it Looks like: Embracing budget-friendly alternatives means making conscious choices in your daily life that help you save money without sacrificing quality. For example, instead of dining out at expensive restaurants, you might choose to cook at home using seasonal and local ingredients. This shift not only cuts costs but also encourages creativity in the kitchen and fosters healthier eating habits. Similarly, opting for second-hand clothes or thrift shopping instead of buying new can greatly reduce your monthly expenses while still allowing you to maintain your personal style. By seeking out these alternatives, you can find joy in discovering new experiences and products that are kinder to your wallet.

Why It's Smart: Choosing budget-friendly alternatives is a savvy financial move that promotes long-term savings and financial stability. By consciously reducing expenses in various areas of your life, you can redirect those funds towards savings, debt repayment, or investment opportunities. This approach fosters a mindset of mindfulness about spending, encouraging you to evaluate the necessity and value of each purchase. Furthermore, many budget-friendly options, such as DIY projects or community events, can lead to a more fulfilling lifestyle by fostering connections and creativity, rather than relying on consumerism for happiness.

Things to Be Aware of: While embracing budget-friendly alternatives can be a rewarding financial strategy, it's vital to remain vigilant about certain pitfalls. For instance, overly restrictive budgeting can lead to feelings of deprivation, which may result in impulsive splurges later on. Additionally, not all cheap alternatives guarantee quality, so it's important to do your research and confirm that the choices you make are sustainable and beneficial in the long run. Finally, keep in mind that while saving money is important, it's also important to balance your budget-conscious choices with occasional indulgences to maintain a healthy relationship with your finances.

Maximize Your Savings With Smart Planning

What it Looks like:

Maximizing your savings with smart planning involves creating a clear budget and tracking your expenses meticulously. This means categorizing your spending into necessary and non-essential items, allowing you to identify areas where you can cut back. For example, if you find that you're spending a significant amount on dining out, you could set a specific limit for restaurant and takeout expenses. Additionally, automating your savings can help; setting up a direct deposit that transfers a portion of your paycheck into a savings account each month guarantees that you are consistently working toward your goal of saving $500. Visualization tools, like charts or apps, can also keep you motivated by showing your progress over time.

Why It's Smart:

Smart planning for savings is vital because it creates a safety net for unexpected expenses and future opportunities. By consistently saving $500 a month, you can build a substantial emergency fund, which can cover unforeseen situations like medical emergencies or job loss. Furthermore, having a healthy savings account allows you to take advantage of investment opportunities or make significant purchases without relying on credit, which can lead to debt. The discipline of saving not only enhances your financial security but also reduces stress and gives you a sense of control over your finances.

Things to Be Aware of:

While maximizing savings is beneficial, it's important to strike a balance between saving and enjoying life. Overly restrictive budgeting can lead to burnout and resentment, so it's important to allow for some flexibility in your financial plan. Additionally, keep an eye on your savings goals relative to your income; if saving $500 a month becomes overly burdensome, it may be worth reassessing your target to confirm it aligns with your overall financial health. Finally, be cautious of inflation and changing financial circumstances, as these can impact your savings goals and necessitate adjustments to your planning strategy.

RELATED POSTS

View all