You might not realize how many secret fees are quietly draining your bank account every month. Common charges like monthly maintenance fees, ATM withdrawal fees, and overdraft fees can really add up. Plus, sneaky subscriptions may go unnoticed until they hit your statement. Keep an eye on your bank statements and consider using budgeting apps to track these expenses. There's more to uncover about hidden fees and how to avoid them effectively.

Key Takeaways

- Monthly maintenance fees may apply unless you meet specific criteria; review your account terms to avoid them.

- Using out-of-network ATMs incurs withdrawal fees, so opt for your bank's ATMs to save money.

- Overdraft fees can exceed $30 per transaction; set up balance alerts to prevent your account from going negative.

- Sneaky subscriptions often convert from free trials to paid services; regularly check your statements to catch these charges.

- Thoroughly read agreements and fine print to uncover any hidden costs associated with services or products you use.

Common Bank Charges You Might Not Know About

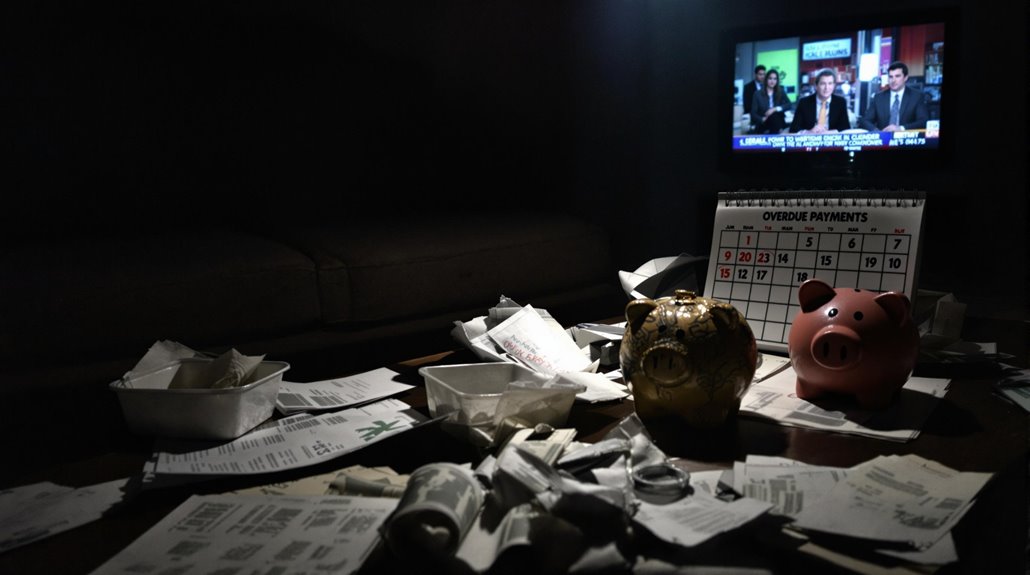

What it Looks like: Many bank customers are often unaware of the various fees that can quietly accumulate in their bank accounts. These charges can include monthly maintenance fees, ATM withdrawal fees, overdraft fees, and even charges for paper statements. For instance, a bank might impose a monthly maintenance fee unless a certain balance is maintained or a specific number of transactions is met. Customers may find themselves paying a small charge each time they use an out-of-network ATM, which can add up noticeably over time. In addition, if an account goes into the negative, the resulting overdraft fees can be quite steep, often exceeding $30 per transaction.

Why It's Smart: Being informed about these hidden bank charges is essential for managing personal finances effectively. By understanding the various fees that can apply, customers can take proactive measures to minimize or avoid them altogether. For example, many banks offer accounts with no monthly fees or those that waive fees for students or seniors. Additionally, setting up alerts for account balances can help prevent overdrafts, while using in-network ATMs can save on withdrawal fees. By being aware of these charges and making small adjustments to banking habits, individuals can save a considerable amount of money over time.

Things to Be Aware of: There are several lesser-known fees that can catch customers off guard. Some banks charge for account inactivity, meaning that if a customer doesn't use their account for a certain period, they may start to incur fees. Additionally, foreign transaction fees can apply when using a debit or credit card abroad, often at rates around 3% of the purchase. Another common yet overlooked charge is for stop payments on checks. Understanding these potential charges and the terms and conditions associated with your bank account can help you avoid unnecessary expenses and keep more money in your pocket.

Sneaky Subscription Services That Keep Costing You

What it Looks like: Many consumers are unaware of the numerous subscription services that quietly siphon money from their bank accounts each month. It's not just the obvious ones like Netflix or Spotify; many people find themselves subscribed to lesser-known services, such as meal kits, fitness apps, or even digital magazine subscriptions. Often, these services offer free trials that convert into paid subscriptions without clear notifications. As a result, individuals may find themselves paying for multiple subscriptions they never intended to keep, leading to a gradual but significant depletion of their finances.

Why It's Smart: Being vigilant about subscription services is a smart financial move because it allows you to regain control over your budget. Regularly reviewing your bank statements can help you identify recurring charges and assess whether you are truly benefiting from each service. If a subscription isn't adding value to your life, it's wise to cancel it. This proactive approach not only saves money but also encourages you to focus on services that genuinely enhance your experiences, helping you cultivate a more intentional spending habit.

Things to Be Aware of: It's important to be aware of the tactics companies use to retain subscribers, such as making cancellation processes difficult or hiding terms and conditions in fine print. Additionally, some services may continue to charge you after a trial period if you do not cancel in time, so always mark your calendar to remind yourself when the trial ends. Moreover, consider using budgeting apps that can help track subscriptions and alert you to any unexpected charges. By staying informed and taking action, you can prevent sneaky subscriptions from draining your bank account.

Tips for Identifying and Avoiding Hidden Fees

What it Looks like: Hidden fees often manifest in various forms, making them difficult to spot until they appear as unexpected charges on your bank statement. Common examples include monthly maintenance fees from your bank, transaction fees for using ATMs outside of your network, and fees for overdrafts or bounced checks. Additionally, service providers like internet and cable companies may include charges for equipment rentals or installation that weren't clearly outlined in the initial agreement. These fees can add up considerably over time, slowly draining your bank account without you even realizing it.

Why It's Smart: Being proactive in identifying and avoiding hidden fees can lead to substantial savings and a healthier financial situation. By thoroughly reviewing your bank statements and billing agreements, you can spot any discrepancies or charges that should not be there. Furthermore, many financial institutions and service providers are willing to waive fees if you simply ask or if you demonstrate loyalty as a long-term customer. Understanding the fine print and asking questions before signing up for any service can empower you to make informed decisions and avoid unnecessary expenses.

Things to Be Aware of: When evaluating your financial statements or service agreements, pay particular attention to terms such as "annual fees," "service charges," and "penalties." These terms often indicate potential hidden costs that could affect your budget. It's also important to keep an eye out for promotional offers that may revert to higher rates after an initial period, leading to unexpected charges. Online services frequently change their pricing structures, so regular monitoring of your subscriptions can help you catch any hidden fees before they become a burden. Always remember to read the fine print; it often contains essential information about fees that you might otherwise overlook.

RELATED POSTS

View all