10 Signs Your Not Financially Prepared for a Major Recession

February 20, 2025 | by Edward Jones

You're not financially prepared for a major recession if you lack an emergency fund, struggle with a high debt-to-income ratio, or live paycheck to paycheck. If you're ignoring budgeting and financial planning while having inadequate insurance coverage and minimal retirement savings, you're at risk. Frequent unplanned expenses and overconfidence in job security further expose you to financial instability. Recognizing these signs is essential, and there's more to uncover about how to safeguard your financial future.

Key Takeaways

- You have no emergency fund, leaving you vulnerable to unexpected expenses and financial shocks.

- Your debt-to-income ratio exceeds 36%, indicating you're allocating too much income towards servicing debt.

- You live paycheck to paycheck, experiencing constant stress about monthly bills and lacking a financial cushion.

- Your insurance coverage is inadequate, exposing you to significant out-of-pocket costs during emergencies or health crises.

- You lack financial diversification, relying solely on one income source, which increases vulnerability to job loss.

Lack of an Emergency Fund

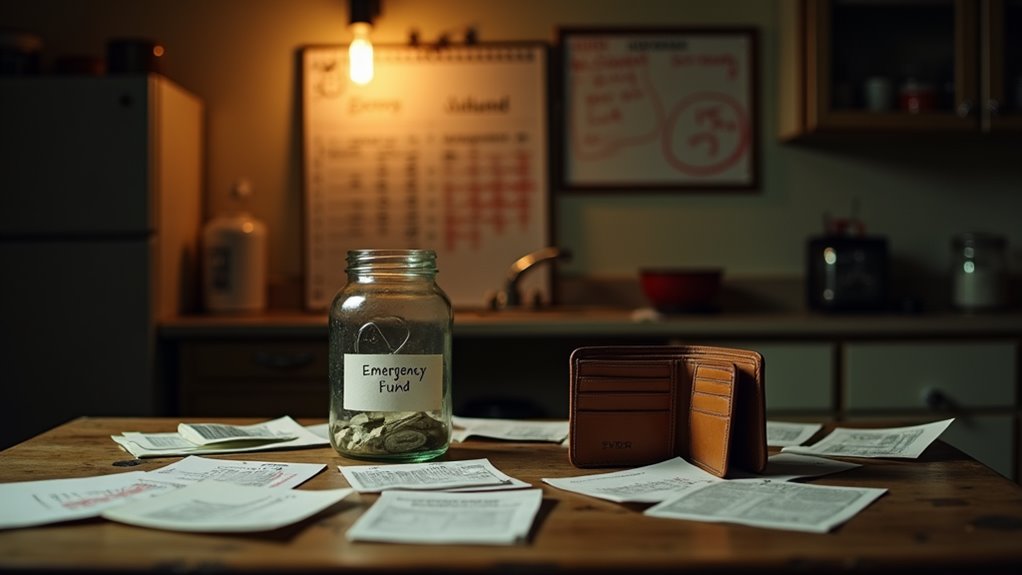

What it Looks like: A lack of an emergency fund often manifests in a precarious financial situation where individuals or families are living paycheck to paycheck. When unexpected expenses arise—such as medical emergencies, car repairs, or sudden job loss—those without an emergency fund may find themselves scrambling to cover costs. This can lead to reliance on credit cards, loans, or borrowing from friends and family, which only exacerbates financial stress and can lead to a cycle of debt. People may also experience anxiety and uncertainty, feeling unprepared for any financial challenges that life may throw their way.

Why It's Smart: Establishing an emergency fund is a key component of financial stability, particularly in times of economic downturn. An emergency fund acts as a financial safety net, allowing individuals to handle unforeseen expenses without derailing their overall financial health. Financial experts typically recommend having three to six months' worth of living expenses set aside in a separate, easily accessible account. This practice not only provides peace of mind but also empowers individuals to make informed decisions during a recession, such as avoiding high-interest debt and maintaining necessary expenses without compromising their long-term financial goals.

Things to Be Aware of: It's important to recognize that building an emergency fund takes time and discipline. Many people may feel overwhelmed by the thought of saving a large sum of money, but starting with small, consistent contributions can lead to significant progress over time. Additionally, it's essential to differentiate between an emergency fund and other savings accounts; the former should be reserved for genuine emergencies only. Finally, remember that as your financial situation changes—whether due to a change in income, family size, or living expenses—your emergency fund needs to be adjusted accordingly to guarantee it remains adequate for your needs.

High Debt-to-Income Ratio

What it Looks like:

A high debt-to-income (DTI) ratio typically indicates that a significant portion of your income is allocated to servicing debt, leaving little room for savings or unexpected expenses. This ratio is calculated by dividing your monthly debt payments by your gross monthly income. If you find that your DTI is above 36%, especially if it exceeds 43%, you may be in a precarious financial situation. In the face of a recession, this high ratio can exacerbate financial strain, as job losses or reduced income can make it increasingly difficult to meet your debt obligations.

Why It's Smart:

Maintaining a low debt-to-income ratio is essential for financial stability, particularly in uncertain economic times. A DTI below 36% not only indicates that you have a manageable level of debt but also suggests that you have room to save for emergencies and invest in opportunities that may arise. Lowering your DTI can improve your credit score, making it easier to secure loans at favorable interest rates when needed. By actively working to reduce your debt, you enhance your financial flexibility and resilience against the challenges posed by a recession, allowing you to weather the storm more effectively.

Things to Be Aware of:

It's important to recognize the signs of a high debt-to-income ratio and the implications it brings. For instance, accumulating debt to maintain a lifestyle can lead to long-term financial insecurity, especially if your income fluctuates or decreases. Additionally, if interest rates rise or if you encounter unexpected expenses, you may find it difficult to manage your debts. Be cautious of lifestyle inflation, and consider prioritizing debt repayment and savings over new purchases. Regularly reviewing your DTI ratio can provide insight into your financial health and help you make informed decisions to prepare for potential economic downturns.

Living Paycheck to Paycheck

What it Looks like: Living paycheck to paycheck is a common scenario for many individuals and families, where income is barely sufficient to cover monthly expenses. This financial state often leaves little to no room for savings, emergency funds, or investments. You might find yourself constantly stressed about upcoming bills, relying on credit cards to get by, or feeling overwhelmed by unexpected expenses. The lack of financial cushion can lead to a cycle of anxiety and uncertainty, making it difficult to plan for the future or respond to financial setbacks.

Why It's Smart: Understanding the implications of living paycheck to paycheck is essential for financial health. By recognizing this pattern, you can take proactive steps to improve your situation. Creating a budget, cutting unnecessary expenses, and setting aside even a small amount for savings can help break the cycle. Additionally, building an emergency fund can provide peace of mind and financial stability, allowing you to handle unexpected situations without resorting to debt. This shift in mindset and behavior can pave the way for a more secure financial future, enabling you to weather economic downturns with greater confidence.

Things to Be Aware of: It's important to acknowledge the various factors that contribute to living paycheck to paycheck, including rising costs of living, stagnant wages, and unexpected financial burdens. Many individuals may find themselves in this situation due to circumstances beyond their control, such as job loss or medical emergencies. However, being aware of your financial habits, seeking resources for financial literacy, and developing a strategic plan can help mitigate the risks associated with this precarious financial state. Taking small, consistent steps toward financial stability can ultimately lead to a more secure and resilient financial outlook, especially in the face of a recession.

No Budget or Financial Plan

What it Looks Like:

When you don't have a budget or financial plan, your spending habits can become erratic and unstructured. You may find yourself living paycheck to paycheck, uncertain of where your money is going each month. Without a clearly defined budget, you are likely to overspend on non-essential items, leading to mounting debts and increasing financial stress. This lack of control can manifest in impulsive buying behaviors, reliance on credit cards, and neglecting savings. Essentially, you're steering your financial life without a map, which can leave you vulnerable in times of economic downturn.

Why It's Smart:

Creating a budget or financial plan is a proactive approach that allows you to take charge of your finances. It helps you track your income and expenses, enabling you to identify areas where you can cut back and save. A solid financial plan not only provides a clearer picture of your current financial situation but also sets goals for the future, such as building an emergency fund or saving for retirement. During a recession, having a budget becomes even more critical as it equips you with the foresight to prepare for potential income disruptions or unforeseen expenses. By being mindful of your finances, you can make informed decisions that prioritize your long-term stability.

Things to Be Aware of:

Without a budget or financial plan, you risk falling into financial traps that could jeopardize your stability during a recession. Be cautious of lifestyle inflation—where your spending increases as your income rises—because it can leave you unprepared for economic challenges. Additionally, failing to monitor your financial health may lead to missed opportunities for savings or investments that could bolster your financial resilience. It's crucial to regularly revisit and adjust your budget to reflect changes in your income or expenses, as well as to account for any shifts in the economic landscape. Being proactive now can safeguard your financial future when times get tough.

Inadequate Insurance Coverage

What it Looks like:

Inadequate insurance coverage manifests when individuals or families find themselves underinsured or lacking essential policies that could protect their financial interests during tough economic times. For example, someone may have only minimal health insurance that doesn't cover major medical expenses, or they might lack sufficient auto or home insurance, exposing them to significant out-of-pocket costs in the event of an accident or property damage. Additionally, not having life insurance or disability coverage can leave loved ones vulnerable should the unexpected occur, placing a greater burden on family finances during a recession when job security and income can be uncertain.

Why It's Smart:

Having thorough insurance coverage is a proactive strategy that can mitigate financial stress during a recession. Insurance acts as a safety net, providing peace of mind and financial stability in times of crisis. For instance, health insurance helps guarantee that medical expenses don't spiral out of control, while homeowners or renters insurance protects against loss or damage to property, which can be particularly damaging during economic downturns. Moreover, life and disability insurance can safeguard against the loss of income, allowing families to maintain their standard of living even if the primary breadwinner is unable to work. Investing in adequate insurance coverage is not merely an expense; it's a financial safeguard that can preserve long-term stability.

Things to Be Aware of:

It's essential to regularly review and assess your insurance coverage to guarantee it meets your current needs, especially as your financial situation, family dynamics, or assets change. Be cautious of the temptation to cut corners or save money by opting for lower coverage limits or higher deductibles, as this may leave you vulnerable during a recession. Also, be mindful of policy exclusions and limitations that could leave you unprotected in unexpected situations. Staying informed about your options and understanding the nuances of your policies can empower you to make better financial decisions and guarantee that you are well-prepared for any economic uncertainty that may arise.

Reliance on a Single Income Source

What it Looks like:

When individuals or families rely solely on one source of income, the financial landscape can quickly become precarious, especially during economic downturns. This dependence means that if that single income stream is disrupted—whether due to job loss, company downsizing, or unexpected health issues—the entire household can face immediate financial strain. For instance, a single-income household may struggle to cover essential expenses like housing, utilities, and food if the primary breadwinner loses their job or is forced to take a pay cut. In such scenarios, savings may become depleted rapidly, leading to a cycle of debt that can be challenging to break.

Why It's Smart:

Diversifying income sources is a fundamental strategy to build financial resilience. By having multiple streams of income—such as side gigs, freelance work, or investments—individuals can buffer themselves against the uncertainties of a recession. This approach not only provides a safety net but also enhances overall financial stability. If one income source falters, others can help maintain the household's financial balance. In addition, multiple income avenues often create opportunities to save and invest more, allowing for greater financial freedom and security in the long run.

Things to Be Aware of:

While diversifying income can be beneficial, it's important to approach this strategy with caution. Juggling multiple responsibilities can lead to burnout and decreased productivity if not managed properly. Moreover, not all side income opportunities are sustainable or reliable; some may require initial investments of time and money that could outweigh their benefits. It's vital to evaluate each potential income source carefully and verify that it aligns with personal skills and market demand. Additionally, maintaining a work-life balance is essential to avoid the negative impacts of stress and overcommitment.

Minimal Savings for Retirement

What it Looks like:

When you have minimal savings for retirement, it often manifests in a lack of a robust retirement account or insufficient contributions to existing plans. You might find yourself relying on Social Security benefits, which are often inadequate for maintaining your pre-retirement lifestyle. This scenario can also include living paycheck to paycheck, where any unexpected expense could jeopardize your ability to contribute to your future savings. If you're unable to set aside a portion of your income regularly for retirement, it's a clear indicator that you aren't financially prepared for a recession, during which your job stability and income could be at risk.

Why It's Smart:

Having a solid retirement savings plan is essential not only for your future security but also for providing peace of mind during economic downturns. When a recession hits, job losses and pay cuts become more common, and not having adequate savings can exacerbate financial stress. By prioritizing retirement savings, you are not only investing in your future self but also creating a financial cushion that can protect you from the volatility of the job market. Consistently contributing to retirement accounts can help guarantee that you have enough resources to cover living expenses, healthcare, and other unforeseen costs that may arise during tough economic times.

Things to Be Aware of:

It's important to recognize that minimal savings for retirement can lead to long-term financial instability. Individuals who do not prioritize retirement savings often face the risk of entering their golden years without adequate resources, which can result in a reliance on family support or continued employment in less desirable jobs. Additionally, the earlier you start saving, the more you can benefit from compound interest, making it essential not to delay contributions. Be aware of your spending habits, and consider reallocating funds towards retirement savings to build a more secure financial future, especially in anticipation of potential economic downturns.

Frequent Unplanned Expenses

What it Looks like: Frequent unplanned expenses are a clear sign that you may not be financially prepared for a recession. These unexpected costs can arise from various sources, such as sudden car repairs, medical emergencies, or home maintenance issues. If you find yourself consistently dipping into credit cards or depleting your savings to cover these unanticipated bills, it indicates that your financial cushion is inadequate. This lack of preparedness can lead to a cycle of debt that becomes increasingly difficult to manage, especially during economic downturns when income may become less stable.

Why It's Smart: Being financially prepared means having a robust emergency fund that can absorb the shocks of unexpected expenses without derailing your budget. When you set aside funds specifically for emergencies, you create a safety net that allows you to handle unforeseen costs without resorting to credit or loans. This not only helps maintain your financial stability but also protects your credit score and overall financial health. Moreover, during a recession, job security may become uncertain, making it even more critical to have a financial buffer to rely on when needed.

Things to Be Aware of: It's important to recognize that frequent unplanned expenses can quickly accumulate and lead to larger financial issues. Being caught off guard by these costs can result in long-term financial stress and anxiety. To mitigate this risk, consider reviewing your budget and identifying areas where you can save or allocate funds towards an emergency savings account. Additionally, tracking your expenses can help you identify potential patterns in unplanned costs, allowing you to address underlying issues and make more informed financial decisions moving forward.

Ignoring Financial Education

What it Looks like: Ignoring financial education manifests in various ways, including a lack of awareness about personal finance topics such as budgeting, investing, and debt management. Individuals may find themselves relying solely on instinct or anecdotal advice from friends and family rather than seeking out reliable sources of information. This can lead to poor financial choices, such as overspending, failing to save adequately for emergencies, and not understanding the implications of high-interest debt. In the face of a recession, those who neglect financial education may struggle to make informed decisions that could safeguard their financial future.

Why It's Smart: Embracing financial education is essential for building a resilient financial foundation, especially during uncertain economic times. By understanding key concepts like asset allocation, risk management, and the importance of an emergency fund, individuals can navigate financial challenges more effectively. Financial literacy empowers people to make informed decisions about their investments, prioritize savings, and develop strategies to mitigate financial risks. Investing time in learning about financial principles not only enhances one's ability to weather a recession but also fosters confidence in managing personal finances long-term.

Things to Be Aware of: It's important to recognize that ignoring financial education can lead to detrimental habits and a lack of preparedness for unexpected economic downturns. Many individuals may mistakenly believe that financial knowledge is only necessary for those with substantial wealth or complex financial situations. However, everyone can benefit from understanding basic financial concepts, as they apply to all income levels and life stages. Be cautious of the pitfalls of financial ignorance, as they can result in increased stress, missed opportunities for growth, and a greater likelihood of financial hardship during a recession. Taking the initiative to educate oneself can be a pivotal step in securing one's financial future.

Overconfidence in Job Security

What it Looks like: Overconfidence in job security often manifests as a lack of proactive financial planning. Individuals who feel secure in their jobs may neglect to build an emergency fund or diversify their income sources, assuming that their current position is stable and will remain unthreatened. This can lead to a false sense of security, where one might overlook the potential for layoffs, company restructuring, or even broader economic downturns that could affect their employment status. As a result, they may spend freely instead of saving or investing for the future, leaving them vulnerable when unexpected changes occur.

Why It's Smart: Maintaining a cautious perspective about job security is essential for financial preparedness. Acknowledging that employment situations can change rapidly encourages individuals to take proactive steps in their financial planning. By building a robust emergency fund, ideally covering three to six months of living expenses, and exploring additional income streams, such as side gigs or investments, one can mitigate the risks associated with job loss. This mindset fosters resilience and flexibility, allowing individuals to navigate economic uncertainties with greater confidence and stability.

Things to Be Aware of: It's important to recognize the signs of overconfidence in job security, particularly in times of economic volatility. Be mindful of the shifts in your industry or company, including any news of layoffs, declining profits, or market fluctuations. Additionally, consider the potential impact of automation and technological advancements on job roles. By staying informed and remaining adaptable, you can better prepare for potential disruptions and guarantee that your financial foundation remains solid, regardless of external circumstances.

RELATED POSTS

View all