To budget effectively during inflation, start by evaluating your financial situation—review your income, expenses, savings, and debts. Prioritize essential expenses like housing and food while cutting unnecessary costs. Explore alternative income sources, such as side hustles or freelance work, to boost your earnings. Adjust your savings goals to keep pace with rising prices, maintaining flexibility in your planning. These tips can help you navigate the challenges of inflation and secure your financial future, so keep going for more insights!

Key Takeaways

- Regularly assess your financial situation by evaluating income, expenses, savings, and debts to identify areas for improvement.

- Prioritize essential expenses over discretionary spending to maintain your quality of life during inflation.

- Explore alternative income sources, such as side hustles or freelance work, to diversify your earnings.

- Adjust savings goals to account for inflation, increasing savings amounts and seeking higher-yield opportunities.

- Maintain a balance between saving and spending to ensure financial health while enjoying life's experiences.

Assess Your Current Financial Situation

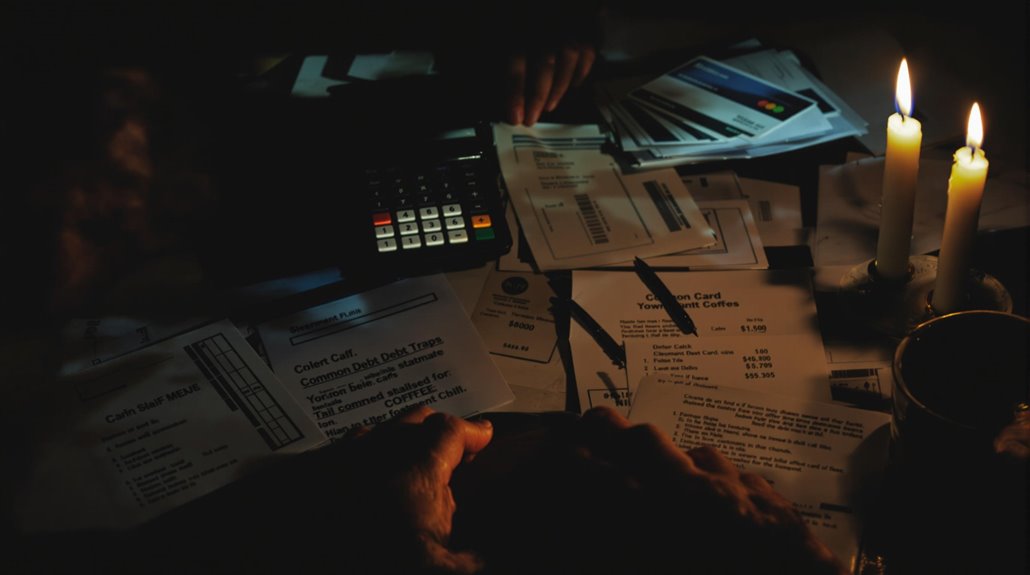

What it Looks like: Evaluating your current financial situation during inflation involves a thorough examination of your income, expenses, and savings. Start by listing all sources of income, including salaries, bonuses, and any side gigs. Next, compile a detailed account of your monthly expenses, categorizing them into fixed costs like rent or mortgage payments, utilities, and variable costs such as groceries and entertainment. Additionally, take stock of your savings, investments, and any debts you may have. This snapshot will give you a clear view of your financial health and help you identify areas where you can cut back or reallocate funds to better prepare for rising costs.

Why It's Smart: Understanding your current financial situation is vital in times of inflation because it allows you to make informed decisions about your spending and saving habits. With prices on goods and services steadily increasing, knowing exactly where your money is going can help you identify unnecessary expenses and prioritize essential spending. By evaluating your finances, you can create a budget that not only accommodates for inflation but also helps build an emergency fund or pay down debt. This proactive approach strengthens your financial resilience, ensuring that you can weather the storm of rising prices without sacrificing your long-term financial goals.

Things to Be Aware of: While evaluating your financial situation is essential, it's important to be mindful of certain factors that may impact your analysis. Market volatility, changes in interest rates, and unexpected expenses can all influence your budget. Additionally, inflation can vary widely across different sectors, meaning some costs may rise more sharply than others. It's vital to remain flexible and regularly revisit your financial evaluation to adapt to these changes. Finally, consider the psychological impact of inflation on spending habits; it can lead to panic buying or overestimating your needs. Balancing caution with a realistic approach can help you navigate your finances effectively during economic uncertainty.

Prioritize Essential Expenses

What it Looks like:

Prioritizing essential expenses during inflation means taking a hard look at your monthly budget and identifying which costs are necessary for your survival and well-being. This typically includes housing, utilities, food, healthcare, and transportation. For instance, you might decide to allocate a larger portion of your income to groceries while cutting back on discretionary spending like dining out, entertainment, and luxury items. Creating a clear list can help you visualize what you absolutely need versus what can be considered a want. This approach allows individuals and families to focus their financial resources on maintaining their quality of life despite rising costs.

Why It's Smart:

Focusing on essential expenses is a smart strategy during inflation because it helps you manage your finances more effectively in uncertain economic times. As prices rise, the purchasing power of your money decreases, making it vital to guarantee that your basic needs are met first. By prioritizing these expenses, you can prevent the accumulation of debt that often stems from trying to maintain a lifestyle that no longer fits your financial reality. Additionally, this approach can provide peace of mind, reducing stress related to financial uncertainty, and allowing you to make more informed decisions about your spending and saving habits.

Things to Be Aware of:

When prioritizing essential expenses, it's important to remain vigilant about the potential for overspending in areas you deem necessary. For example, while food is essential, it can be easy to fall into the trap of purchasing more expensive brands or convenience items. Being aware of sales, using coupons, and planning meals can help mitigate this risk. Moreover, keep an eye on how inflation affects different sectors; for instance, utility costs may spike unexpectedly. It's also vital to review and adjust your priorities regularly as financial situations and inflation rates change, guaranteeing that your budget remains flexible and responsive to your needs.

Cut Unnecessary Costs

What it Looks like: Cutting unnecessary costs during inflation involves a thorough examination of your monthly expenses to identify areas where you can reduce spending without markedly impacting your quality of life. This might include revisiting subscriptions and memberships, canceling services you rarely use, or opting for generic brands instead of name brands when grocery shopping. It can also mean limiting discretionary spending, such as dining out or indulging in non-essential purchases. By taking a hard look at your budget and prioritizing your needs over wants, you can create a leaner financial plan that helps you navigate the challenges of rising prices.

Why It's Smart: In an inflationary environment, the cost of goods and services tends to rise steadily, meaning that your purchasing power decreases over time. By cutting unnecessary costs, you not only free up more money for essentials but also create a buffer against the impact of inflation on your overall financial health. This strategic approach allows you to allocate more resources towards savings or investments, which can help combat inflation in the long run. Additionally, being mindful of your spending habits can cultivate a more intentional approach to budgeting, ultimately leading to better financial stability and resilience in uncertain economic times.

Things to Be Aware of: While cutting costs can be beneficial, it's important to strike a balance so that you do not compromise your well-being or quality of life. Avoid drastic measures that could lead to dissatisfaction or stress, such as eliminating all forms of entertainment or social activities. Instead, focus on moderate adjustments that maintain some enjoyment in your life while still being financially prudent. Additionally, be cautious of any potential hidden costs that might arise from cutting certain services or products, such as opting for cheaper alternatives that may require more frequent replacements. Always consider the long-term implications of your budget adjustments to verify they align with your overall financial goals.

Explore Alternative Income Sources

What it Looks Like:

Exploring alternative income sources during inflation can take many forms. Individuals might contemplate side hustles such as freelance work, consulting, or offering services based on their skills, such as graphic design, writing, or tutoring. Additionally, investing in rental properties or participating in the gig economy through platforms like Uber or TaskRabbit can provide additional cash flow. Many people are also turning to online marketplaces to sell handmade goods or vintage items. The goal is to diversify income streams to buffer against rising costs and safeguard financial stability.

Why It's Smart:

Diversifying income sources is particularly wise during inflationary periods when the cost of living increases and purchasing power decreases. By creating multiple streams of income, individuals can mitigate the risk of relying solely on a single job or salary, which may not keep pace with inflation. Moreover, alternative income sources can also provide opportunities for personal growth and skill development. Engaging in side projects can not only supplement income but also foster creativity and passion, potentially leading to new career opportunities or business ventures.

Things to Be Aware of:

While exploring alternative income sources can be beneficial, there are several factors to keep in mind. Time management becomes essential, as balancing a side hustle alongside full-time employment can lead to burnout if not handled carefully. It's also important to assess the financial viability and potential risks associated with new ventures, such as initial investments required for starting a business or the unpredictability of gig work. Additionally, individuals should remain aware of tax implications and guarantee they are compliant with regulations regarding secondary income. Setting realistic expectations and maintaining a strategic approach will enhance the likelihood of success in these alternative income endeavors.

Adjust Your Savings Goals

What it Looks like: Adjusting your savings goals during inflation means re-evaluating how much you need to save to maintain your purchasing power. For instance, if you previously aimed to save a specific amount for a vacation or a new car, you might need to increase those savings targets to keep pace with rising costs. This could involve setting aside a higher percentage of your income or reallocating funds from less significant expenses to your savings. It's also essential to evaluate the time frame for your savings goals, as prolonged inflation may require a more aggressive approach to reach the same financial milestones.

Why It's Smart: Revising your savings goals helps you stay ahead of inflation's impact on your financial stability. By proactively increasing your savings, you can mitigate the erosion of your purchasing power and guarantee that you're prepared for future expenses. This approach not only allows you to keep up with rising prices, but it also instills a sense of financial discipline and awareness about your spending habits. Additionally, adjusting your savings goals can encourage you to seek out higher-yield savings accounts or investment opportunities that may offer better returns, helping you grow your savings more effectively in an inflationary environment.

Things to Be Aware of: When adjusting your savings goals, it's important to weigh the balance between saving and spending. While it's important to save more during inflation, overzealous saving can result in missed opportunities for enjoyment or investment. Additionally, keep an eye on your budget and verify that essential expenses are prioritized. Be mindful of the psychological aspects of saving during inflation; it can be easy to feel overwhelmed or anxious about financial security. Finally, remember that inflation rates can fluctuate, so regularly reassessing your savings goals is essential to guarantee they remain relevant and achievable.

RELATED POSTS

View all