To avoid catastrophic investing mistakes, start by conducting thorough research and understanding a company's financial health. Don't let emotions drive your decisions; stick to a disciplined strategy instead. Diversify your investments to reduce risk, and always consider fees and expenses that can chip away at your returns. Keep these traps in mind to enhance your investment strategy and boost your long-term wealth. There's more you can do to safeguard your financial future.

Key Takeaways

- Conduct thorough research and analysis to avoid impulsive investment decisions based on trends or hearsay.

- Recognize and mitigate emotional biases, like FOMO and loss aversion, to maintain rational decision-making.

- Diversify your portfolio across different asset classes to reduce risk and stabilize performance.

- Be aware of fees and expenses that can erode your investment returns over time.

- Develop a long-term strategy that includes regular assessments of costs and financial implications for better wealth building.

Lack of Research and Due Diligence

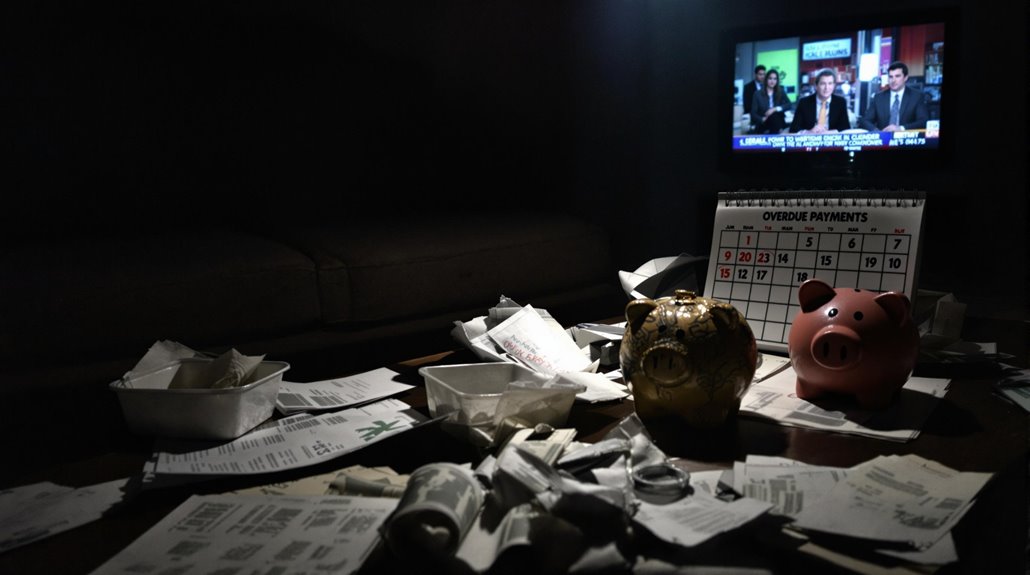

What it Looks like: A lack of research and due diligence in investing often manifests as impulsive decision-making. Investors might jump into stocks, bonds, or other investment opportunities based on hearsay, trends on social media, or a gut feeling, rather than thorough analysis. For example, an investor may purchase shares of a popular tech company simply because a friend recommended it, without understanding the company's financial health, market position, or growth potential. This approach can lead to poor investment choices and significant financial losses, as the investor is not equipped with the necessary knowledge to make informed decisions.

Why It's Smart: Conducting thorough research and due diligence is vital for successful investing. By taking the time to analyze a potential investment's fundamentals, such as its earnings reports, competitive landscape, and macroeconomic factors, investors can better gauge whether the asset is likely to appreciate in value. Additionally, due diligence helps investors identify potential risks associated with a particular investment, allowing them to make more informed choices that align with their financial goals and risk tolerance. Ultimately, being diligent in research can enhance an investor's confidence and ability to navigate the complexities of the financial markets.

Things to Be Aware of: Investors should be mindful of the information sources they rely on during their research. Relying solely on anecdotal evidence, unfounded tips, or sensationalized news can lead to misguided decisions. It's important to use reputable sources, including financial news outlets, company reports, and expert analyses. In addition, investors should be wary of confirmation bias, which can occur when they only seek out information that supports their pre-existing beliefs about an investment. Instead, a holistic approach that considers multiple perspectives and data points will foster a more robust understanding and lead to better investment outcomes.

Emotional Decision Making

What it Looks like:

Emotional decision making in investing often manifests as impulsive buying or selling based on fear or excitement. For instance, when the market experiences a sudden downturn, an investor might panic and sell off their stocks at a loss, fearing further decline. Conversely, during a market rally, the excitement can lead to hasty purchases of overvalued assets, driven by the fear of missing out (FOMO). Investors might also exhibit attachment to particular stocks, holding on to them despite poor performance simply because of emotional ties or past successes. This kind of behavior can result in a portfolio that suffers from volatility and suboptimal returns.

Why It's Smart:

Avoiding emotional decision making is vital for long-term investment success. Investors who rely on rational analysis and a disciplined strategy are more likely to make informed decisions that align with their financial goals. By sticking to a well-thought-out plan, such as dollar-cost averaging or rebalancing a portfolio based on set criteria rather than market noise, investors can mitigate risks associated with emotional choices. Additionally, maintaining a focus on fundamentals—like a company's earnings, market position, and growth potential—can help steer decision-making away from fleeting emotions and toward sound financial judgment.

Things to Be Aware of:

Investors should be mindful of the psychological traps that can lead to emotional decision making. Cognitive biases, such as loss aversion and overconfidence, can distort judgment and lead to poor investment choices. It's important to recognize situations where emotions may cloud judgment, such as during significant market events or personal financial stress. Implementing strategies like setting predefined buy/sell thresholds, using automated investing tools, or even seeking advice from financial professionals can help counteract emotional impulses. Remaining aware of one's emotional state and its potential impact on investment decisions is essential for achieving lasting financial success.

Overlooking Diversification

What it Looks like:

Overlooking diversification in your investment portfolio often manifests as a concentrated risk in a few assets or sectors. Investors may find themselves heavily invested in a single stock or a specific industry, believing in its potential for growth without considering the broader market dynamics. This lack of diversification can lead to significant volatility in an investor's portfolio; for example, if the technology sector experiences a downturn, an investor heavily weighted in tech stocks may suffer heavy losses, while a more diversified portfolio would likely mitigate this impact by spreading risk across various asset classes and sectors.

Why It's Smart:

Diversification is a fundamental principle of risk management in investing. By spreading investments across different asset classes—such as stocks, bonds, real estate, and commodities—investors can reduce the overall risk of their portfolio. This strategy works on the premise that not all assets will react the same way to economic changes, market fluctuations, or sector-specific events. When one asset class may be performing poorly, others may be thriving, providing a stabilizing effect on the overall portfolio performance. Ultimately, this approach can lead to more consistent returns over time, allowing investors to weather market volatility with greater ease.

Things to Be Aware of:

While diversification is a key strategy for reducing risk, it's important to understand that it doesn't eliminate risk entirely. Over-diversification, or spreading investments too thinly across too many assets, can dilute potential returns and make it difficult to track performance effectively. Additionally, investors should be mindful of correlation; assets that are too closely related may not provide the intended risk reduction. For instance, holding multiple stocks in the same industry may not offer the protection that a more varied asset allocation would. As a result, creating a well-balanced portfolio requires careful consideration of asset types and their relationships to one another.

Ignoring Fees and Expenses

What it Looks like: Ignoring fees and expenses is often a silent killer of investment returns. Investors may focus solely on the potential gains of a particular asset or fund while overlooking the associated costs. This can manifest in various ways, such as neglecting to read the fine print of mutual fund prospectuses, failing to account for transaction fees when trading stocks, or not considering the management fees charged by financial advisors. Over time, these expenses can accumulate, greatly eroding the overall profitability of an investment strategy, sometimes without the investor even realizing it.

Why It's Smart: Being aware of fees and expenses is vital for maximizing your investment returns. Different investment vehicles come with varying costs, and even a seemingly small difference in fees can lead to substantial differences in the final value of your portfolio over the long term. By conducting thorough research and comparing the costs associated with different investment options, you can make more informed decisions that align with your financial goals. Understanding the impact of these fees guarantees that you are not only chasing returns but also safeguarding your investments from unnecessary losses.

Things to Be Aware of: It's important to recognize that some fees may not be immediately apparent. For instance, expense ratios in mutual funds can hide additional fees like sales loads or redemption fees. Additionally, advisory fees can vary greatly between firms, and some may charge a percentage of your assets under management, which could incentivize them to recommend higher-cost investments. Always take the time to evaluate all potential costs associated with your investments and consider how they will impact your long-term wealth. By being vigilant about fees, you can enhance your investment strategy and ultimately improve your financial outcomes.

RELATED POSTS

View all